Global porfolio is a desired diversification

This piece is written from perspective of investor in Malaysia

Global portfolio is a form diversification in term geographical (and even geopolitical)

- Malaysia equity market is a stock picker’s market – you won’t get a positive return (let alone beat the inflation) if you simply invest in all large cap or even top 100 stocks.

- You may refer to FTSE Bursa Malaysia Index Series report dated 30 June 2022 (link here) and see that for the past 5 years (ending June 2022) all FBM indices (KLCI, Mid 70, and Small Cap) gives between -3.7% to -4.0% annualised (compounded) on capital return

- Going global is sensible move considering that certain key economies like US, China and India are thriving for the past decade especially when compared to other economies

- However, focusing on any single country will put you on the country risk, plus despite interlinked market in the current globalised economy, some market react differently from others

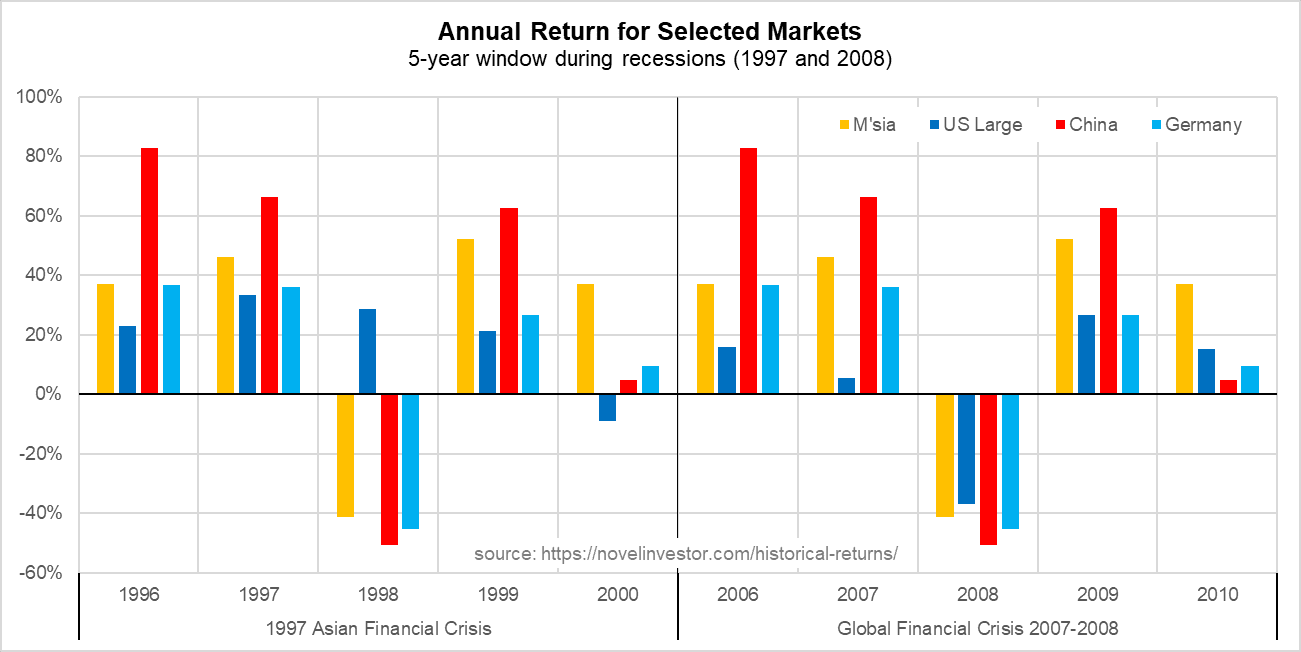

- US wasn’t affected during 1997 Asian Financial Crisis (1997 Asian financial crisis - Wikipedia) , but avoiding China altogether would mean losing the opportunity of great growth from the country

- US market were abysmal in 2006 and 2007 before totally tanked in 2008 during Financial crisis of 2007–2008 - Wikipedia (but so do others). But avoiding it would mean losing out tremendous growth from US market since then (averaging 14.7% p.a. for past 10 years 2012-2021)

Modern Equity Market are interlinked but there’s still value in global equity vs US alone

- For past 15 years US market only experience 2 years of negative return and most of the positive returns are above 15% (with 5 years above 20% )

- ![[pic annual return select market 2006 2021.png]]

- During 1997 Asian Financial Crisis, US is largely unaffected, but also have (relative to others) below average return

- Meanwhile during Global Financial Crisis (2007-2008), Malaysia and China market rebounded swiftly while US rebound is more tapered

- ![[pic 5-year window recession 1997 2008.png]]

- Building a global portfolio would require understanding how to allocate to achieve desired risk-reward balance. This will revolve around understanding the regional risks, allocation ratio and portfolio rebalancing. Perhaps I’ll explore this matter in another post